Key Takeaways

- Significant Savings and Sustainability: Eco-friendly home upgrades like LED lighting, high-efficiency appliances, and solar panels not only reduce your carbon footprint but also offer substantial savings on utility bills. These green choices can lead to long-term financial benefits, including lower energy costs and potential tax incentives.

- Improved Home Comfort and Health: Upgrading to energy-efficient windows, adding insulation, and using sustainable materials can significantly enhance your home’s comfort. These improvements lead to better temperature control, reduced noise levels, and improved air quality, creating a healthier living environment for you and your family.

- Increased Property Value: Investing in eco-friendly home upgrades can raise your property’s value and appeal to future buyers. Features like solar panels and energy-efficient appliances make your home stand out in the market, potentially leading to a higher appraisal value and a quicker sale.

In today’s world, sustainability has infused every aspect of our lives, from recycling, to buying local, to eating farm-to-table. Our homes are no exception to the great push into going green, with many home buyers looking for eco-friendly homes that are cozy, comfortable havens with a smaller utilities footprint.

On top of adding appealing features to your home for potential buyers, you might want to look to eco-friendly upgrades for the tangible benefits of saving money, enhancing comfort, and increasing property value.

Why Eco-Friendly Homes Are a Big Deal

Your home is more than just a place to crash, it’s a reflection of your personality and values. Eco-friendly home upgrades are designed to reduce your household’s carbon footprint by utilizing less water, energy, and natural resources. These upgrades can significantly reduce your monthly utility bills, improve indoor air quality, and even raise your property value.

These upgrades not only cut down on your utility bills (though that’s a pretty sweet perk!); they also improve air quality, creating a healthier, more comfortable space for your loved ones. Energy-saving windows, for example, can raise your property value and give your home that special glow that says, “Hey, future buyers, I’m a gem!”

Since energy costs are continually rising, and homebuyers are increasingly environmentally conscious, the appeal of a sustainable home has never been higher.

The Best Spots to Go Green

Let There Be (LED) Light: Swapping out those old bulbs for LED ones? A total game-changer for saving energy. Upgrading to LED lighting, energy-efficient appliances, and smart thermostats can drastically save on energy consumption. High-efficiency heating and cooling systems also save energy while making your home more comfortable. One thing about LED bulbs I learned the hard way is that you’ll also want to change your wall switch if you want them to last for the maximum lifespan.

Water-Saving Wonders: Those low-flow faucets, showerheads and toilets? They reduce water usage without significantly compromising performance.

Cozy Up with Insulation: Upgrading your insulation and investing in energy efficient windows help keep your home comfy season after season. Look for products with high R-values and ENERGY STAR ratings to keep your home comfortable year-round, reduce energy consumption, and lower heating and cooling costs.

Solar Panels: Sunshine Superheroes: Imagine tapping into the Sun’s power to light up your home. Solar panels do just that AND seriously cut down your electricity bills. Solar panels are a big investment, but they can pay for themselves and then some over the long-term by reducing your electric bill. In some cases, you’ll even come across government incentives or tax breaks to make this an even sweeter deal. Keep in mind that solar panels have a drop-off in power production over time (often after 10 years). So, give this one plenty of thought and research before deciding if solar power is right for your home.

Stylish and Sustainable Materials: From bamboo floors to recycled glass countertops, choosing sustainable materials means your home is not just green—it’s stylish too. If you’re having a custom home built, or renovating an existing home, keep an open mind to sustainable materials like bamboo flooring, recycled glass countertops, recycled brick, reclaimed wood, and non-VOC paints. These materials are environmentally friendly, can make your home healthier, and add unique beauty and character by incorporating more natural materials. It can even be friendlier for your budget if you try sourcing recycled and reclaimed materials through Facebook Marketplace or Nextdoor.

The Wallet-Friendly Perks of Going Green

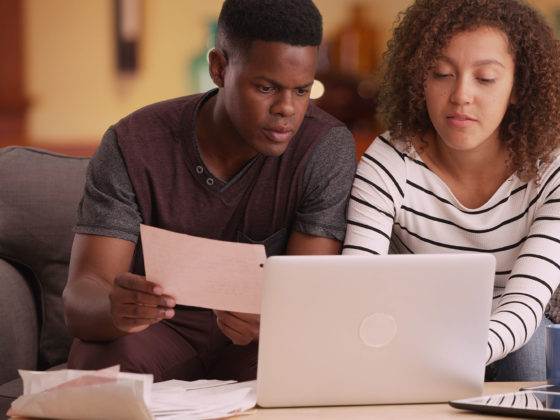

I know I talked about how each of these eco-friendly upgrades saves you money, but I want to talk about the big financial picture. Investing in green upgrades can be an investment up front, so the out of pocket can seem like a big hurdle to get to the benefit of long-term savings.

But think about the freedom of having fewer monthly bills and more going back into savings each month for years! Upgrades like these truly are the gift that keeps on giving – giving peace of mind, savings, and growing home equity. Lower utility bills, less maintenance, and even some sweet tax incentives make these upgrades a smart move for your budget and your financial wellbeing for years to come. Consider that energy and repair costs will keep rising in the future, so your monthly savings will get better with age too!

A Home That Hugs You Back

Beyond the savings, there’s something magical about living in an eco-friendly home. It’s like it breathes along with you, offering cleaner air, a quieter, more serene environment, and that just-right feeling all year round. And when the time comes to sell, these green upgrades can translate into a higher appraisal, more home equity, and make your home stand out to potential buyers.

Kickstarting Your Green Savings

Feeling inspired? Starting your eco-friendly journey doesn’t have to be an all-or-nothing leap. Begin with a few small changes and watch how they start to add up. Every step toward sustainability brings you closer to a home that is more comfortable, cost-effective, and appealing to future buyers.

Real Stories, Real Impact

At Milend, we’ve seen the incredible difference eco-friendly upgrades can make. Take the Nguyens, whose new, efficient windows, caulk and insulation, and LED lighting made their home the coziest and brightest spot on the block. The Department of Energy says the average homeowner to make these two upgrades will save $690 in energy costs each year! Imagine what’s possible for your home and budget if you save 40% on your energy bills.

Let’s Do This, Together!

Sustainability is already a part of our daily lives. It’s about making thoughtful choices that benefit our wallets, our health, and our future.

If you’re inspired to make your home more sustainable and want to learn more about eco-friendly upgrades, sign up for our newsletter. You’ll receive the latest tips, success stories, and insights to help you navigate your eco-friendly and budget-friendly home improvement journey.

Together, we can make our homes work better for the way we live, our wallets, our health, and build a future of financial freedom for ourselves and our loved ones. Let us know in the comments or use the contact page to tell us how we can support your home financing journey.

Let’s Grow Together

As we navigate the spring market and beyond, let’s remember the values that bind us: trust, commitment, personal growth, and the importance of home. If you’re pondering your next move or seeking guidance in the ever-changing real estate landscape, reach out. Together, we can explore your options, prepare for the future, and turn the dream of homeownership into reality.

Stay tuned for more insights, and don’t hesitate to join our community for updates, tips, and stories that celebrate our journeys home, one step at a time.

Spring Market Preview: What to Expect in Real Estate

Read more...