Key Takeaways

- Fed Rate Cuts Don’t Directly Lower Mortgage Rates: Despite the Federal Reserve lowering the prime rate, mortgage rates remain steady above 6.5%. Understanding the factors that influence mortgage rates can help buyers and homeowners navigate their financial decisions.

- Housing Inventory and Economic Indicators Matter More: Key factors like housing inventory and broader economic trends often play a larger role in determining mortgage rates than changes in the Fed rate alone.

- Planning for 2025 Housing Trends: Learn how steady mortgage rates, inventory challenges, and market trends might affect homebuying or refinancing opportunities in the coming year.

Heading into 2025, many homeowners had hoped that Federal Reserve rate cuts would lead to an adjustment in the housing market and significantly lower mortgage rates. Despite several rate adjustments late last year, interest rates on 30-year fixed-rate mortgages have held relatively steady at around 7% after an initial brief dip. The Federal Reserve’s latest rate cut of a quarter basis point in December brings total rate cuts to a 1% reduction since September 2024.

This raises an important question: Why haven’t these cuts made mortgages more affordable, and what can we expect to happen with mortgage rates in 2025?

Mortgage Rates and Fed Cuts: The Disconnect

The big disconnect between expectations and reality is that mortgage rates don’t directly follow Fed rate cuts—they respond to more complex factors like bond yields, lender margins, and market demand. While the federal funds rate sets the tone for short-term borrowing costs, reductions in the Federal Reserve’s rates don’t automatically guarantee lower interest rates on long-term assets, like your home loan.

Mortgage rates are heavily influenced by long-term economic factors, and the factor that plays into long-term mortgage rates the most is the yield on the 10-year Treasury bond. These yields are shaped by inflation, market sentiment, and global economic conditions. When inflation is high or markets are volatile, Treasury yields stay elevated and mortgage rates tend to remain high as well.

Even with the Fed trimming the Fund Rate, inflationary pressure and market uncertainty have kept mortgage rates from dropping the way potential home buyers or homeowners looking to refinance had hoped.

Putting Current Rates into Perspective

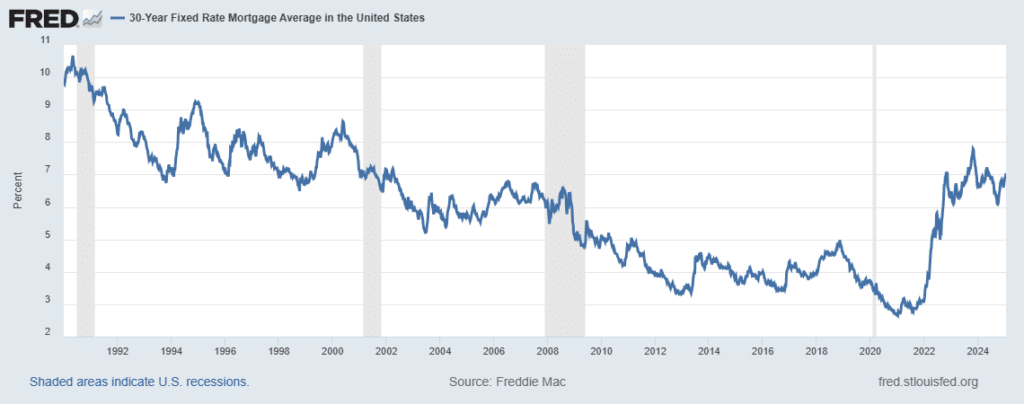

While mortgage rate drops haven’t matched the hype accompanying the Federal Reserve’s decision to start rate cuts last year, current rates have less to do with mortgage affordability than you might think. Those sub-3% mortgage rates many remember from 2021 were an exceptionally low anomaly – the result of aggressive intervention by the Federal Reserve during the COVID-19 pandemic, slashing the Fed Funds Rate to near zero to support and stabilize the economy.

Historically, mortgage rates in the range of 6-7% are much more representative of what we might consider “normal” market conditions. To put this into perspective, during the 1990s and early 2000s, mortgage rates routinely fluctuated between 5% and 8%. While today’s rates may seem high compared to pandemic-era lows, they are aligned with historical averages.

Current rates have a bigger effect on mortgage affordability simply because this “normal” rate environment follows on the heels of historically low mortgage rates, contributing to low housing inventory.

Inventory is Still Impacting Affordability

While mortgage rates have hogged the limelight on affordability, we can’t ignore the role limited inventory has played in keeping the housing market expensive. Many homeowners who refinanced their mortgages during the historically low 3% interest rate era are now opting to stay put, rather than sell and take on new loans at the higher rates available today. This “rate lock-in” effect has led to a stagnant housing supply, with fewer properties being listed for sale.

In an encouraging market shift, there was a notable uptick in active listings in November 2024—up 12.1% from one year prior. Over half of these homes, however, have been on the market for more than 60 days—often because they are overpriced or in less desirable condition. Despite the increase in new and existing homes being listed, the reality is that home prices do not appear to be dropping significantly any time soon.

Amid calls to build more homes to alleviate inventory shortages, market data suggests plenty of new construction listings are on the market. Rather than slashing prices to move more homes, many builders may opt to rent out homes rather than releasing more inventory. Coupled with a flood of investors paying cash and flipping properties to capitalize on pricing growth trends, these trends pressure home prices to remain high or rise further, even as demand cools due to higher rates.

Image Source – CNBC Video “Why Fed rate cuts aren’t making mortgages cheaper”: https://www.cnbc.com/video/2024/12/21/why-fed-rate-cuts-arent-making-mortgages-cheaper

Looking Ahead to 2025

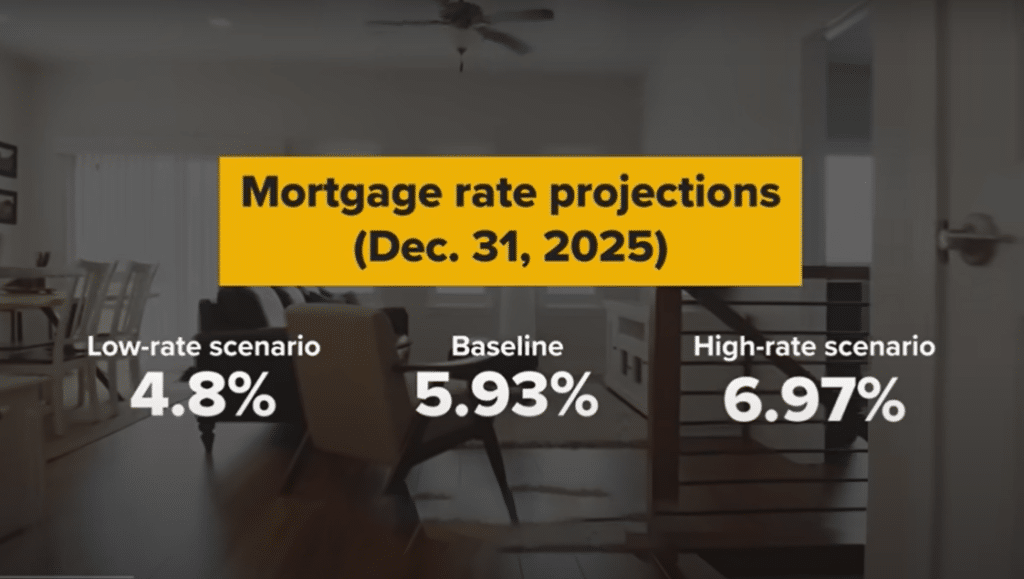

As we head into 2025, the Fed is expected to continue gradually cutting rates in an attempt to make housing more affordable, but mortgage rates may not follow suit. Expert forecasts indicate mortgage rates could remain above 5.5% throughout 2025, while others suggest rates are more likely to stabilize closer to 7-7.5% for 30-year fixed loans. As the housing market adjusts to this new reality, buyers are increasingly learning to adapt to what is now a “new normal” for mortgage rate after two years where mortgage rates averaged above 6%.

What Does This Mean for You?

If you’re planning to buy a home, it’s important to think long-term. While home prices may feel high now, home ownership remains one of the most stable and rewarding investments. Current mortgage rates are higher than they were during pandemic lows but are indicative of a normal housing market, and the “rate lock-in” effect making homeowners hesitant to sell has an expiration date.

While housing inventory is still limited, with builders and sellers holding out higher demand, we could see home prices go up from their current high. Pricing in the housing market generally increases over time and rarely adjusts down. By buying a home at current prices, you may benefit in the future as values continue to rise.

For current homeowners, exploring options to tap into your home’s equity could offer financial relief. Home Equity Lines of Credit (HELOCs) can allow you to access funds for renovations while keeping your existing mortgage rate. Leveraging a Cash Out Refinance to consolidate debt could potentially offer relief by saving you money on monthly debt payments.

Navigating the Market with Confidence

As we transition into 2025, it is clear that the housing market continues to face challenges, but it still holds opportunities for informed, proactive buyers and homeowners. That’s why it’s essential to stay updated on economic indicators like 10-year bond yields, Federal Reserve policies, and housing inventory.

Whether you’re looking to buy, sell, or leverage your equity, a knowledgeable mortgage professional can guide you through the best timing and financing options to achieve your goals.

Homeowner’s Fall Maintenance Checklist: Prepare Your Home for the Colder Months Ahead

Read more...