Key Takeaways

Affordability is More Than a Monthly Payment

Online estimates often leave out key costs like property taxes, insurance, HOA dues, and PMI. It’s important to look beyond the number on a home listing and calculate your real monthly budget.Loan Programs Can Help You Buy with Less Out-of-Pocket

You don’t need 20% down to buy a home. With options like FHA, VA, and down payment assistance programs, there are ways to keep upfront costs manageable—especially for first-time buyers.Know Your Numbers and What You’re Comfortable With

Lenders use guidelines like the 28/36 rule to help define affordability, but the final decision should be based on your personal budget, goals, and lifestyle after you move in. Working with a lender can help you find the right fit.

If you’ve ever been on Zillow and found a house you love, you’ve probably noticed that estimated mortgage payment box under the listing price. But here’s the thing—that number doesn’t tell the whole story.

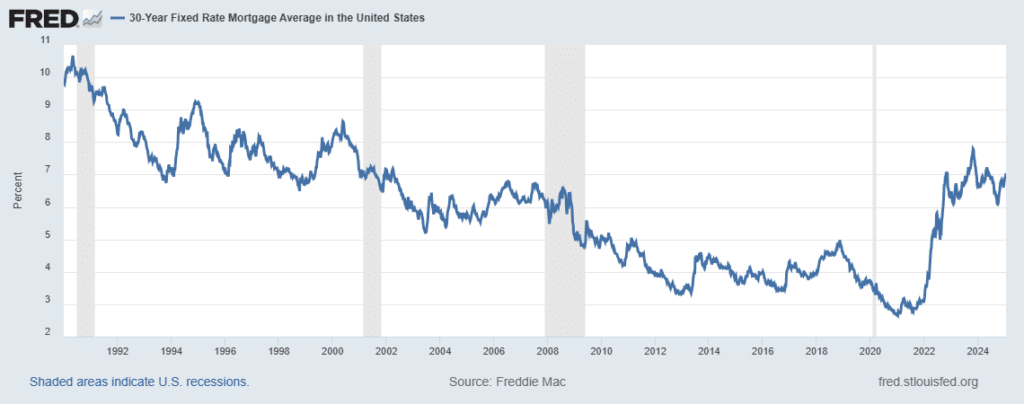

With home prices and mortgage rates both higher than we’ve seen in years, figuring out how much house you can actually afford takes more than just looking at a monthly payment estimate online. Whether you’re buying your first home or planning a move, here’s how to evaluate affordability the right way—and how a loan expert can help you get the best terms for your situation.

Look Beyond the Monthly Mortgage Payment

When you see a monthly payment listed on a home search site, that number typically includes:

- Principal & Interest (based on current average rates)

- Maybe property taxes and insurance (though often under-estimated)

- Rarely any HOA fees or PMI (Private Mortgage Insurance)

What’s often missing:

- Actual local property taxes (which vary county by county)

- Current homeowners insurance premiums

- PMI, which applies if you’re putting less than 20% down

- HOA dues, which can add hundreds a month depending on the neighborhood

💡 Quick tip: Always assume the monthly estimate online is a rough guess. The actual cost may be higher or lower depending on your loan type, credit score, and local taxes.

Understand Your Real Budget

Before falling in love with a home, it helps to understand what price range you can comfortably shop in. A good rule of thumb is to stay within these ranges:

- 28% of your gross income = your housing budget (mortgage, taxes, insurance, HOA)

- 36% of your gross income = your total debts (housing + credit cards, car payments, loans)

💬 Example:

If you earn $7,000/month before taxes:

- Try to keep total housing costs under $1,960

- Keep total debts (including housing) under $2,520

Factor In Your Down Payment & Closing Costs

Most people don’t have 20% down saved, and that’s okay! There are plenty of loan programs designed to help buyers purchase with less money out of pocket:

- Conventional loans – often as low as 3–5% down for qualified buyers

- FHA loans – 3.5% down with more flexibility on credit

- VA loans – 0% down for eligible military service members and veterans

- Down payment assistance programs – available in many states for first-time buyers

🏡 The smaller your down payment, the more likely you’ll pay PMI. But with the right loan setup, it’s possible to reduce or remove PMI later.

And don’t forget closing costs, which usually run about 2–5% of the home price. Partnering with a good mortgage lender will help you navigate these options and educate you on the best loan option for you.

Know What Affects Your Interest Rate

Your interest rate isn’t just based on the market—some of the factors that go into getting your best mortgage rate include:

- Credit score – higher = better rate

- Loan amount and term – 15-year vs 30-year loans have different rates

- Points – you may be able to pay a little upfront to “buy down” your rate and save long-term

- Loan type – Conventional, FHA, VA, or even jumbo loans all price differently

Working with the right lender can make a big difference at this point because a mortgage expert can work to meet your exact financial goals and put together the best loan options around your down payment, monthly payment, and mortgage rate needs.

Calculate Your Total Monthly Payment

Here’s what your real monthly mortgage payment might include:

- Principal

- Interest

- Property taxes

- Homeowners Insurance

- PMI (if required)

- HOA fees (if applicable)

You can get a quick and easy estimate of how much home you can afford using our online Mortgage Calculator or call one of our licensed mortgage experts to run your numbers based on your actual credit, debts, income, and goals. They’ll show you a detailed breakdown, including what your upfront costs and monthly payment will really look like.

Think About Life After You Move In

Affordability isn’t just about qualifying for a loan. It’s also about feeling comfortable month to month after the move. Ask yourself:

- Will you have a cushion for maintenance, repairs, or upgrades?

- Are you still able to save for emergencies or retirement?

- Would you feel better with a lower monthly payment, even if it means buying a smaller home or in a different area?

The goal isn’t just to get approved—it’s to feel good about your new home and your financial life after the move.

Final Thoughts: What Can You Really Afford?

If you’re trying to figure out what you can afford in this market, don’t rely on home search estimates alone. Additional costs of homeownership like mortgage insurance, taxes, cost-of-living differences in that area, and home maintenance are rarely included in online calculators.

Homeownership is an investment in your future that makes more financial sense than renting—especially since rental prices keep rising. Once you know your real numbers and talk to a lender about loan programs that can help with your down payment, you’ll be able to house-hunt with confidence, and you may be surprised to find that your first home or next home is closer than you think.

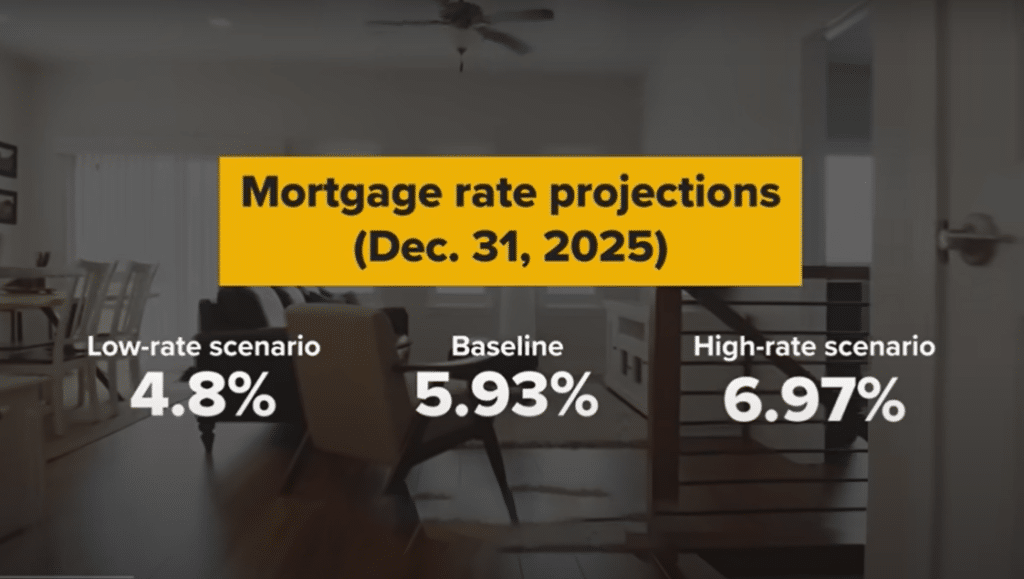

While there are credit factors that help affordability, you don’t have to have a perfect credit score, a 20% down payment saved, or wait for lower interest rates to get approved for a home. A great lender can help you look at the full picture and find loan programs that make a home affordable for you right now.

2025 Mortgage Trends: Why Fed Rate Cuts Aren’t Helping Homebuyers

Read more...