Key Takeaways

Stagflation May Push Mortgage Rates Higher

Despite Fed efforts, inflation and economic stagnation could keep mortgage rates elevated in 2025—making it a smart time to explore rate locks or refinancing options before further increases.Homeowners Can Use Equity to Reduce Monthly Debt

With home values still rising, tapping into your home equity through a cash-out refinance may be a powerful way to consolidate high-interest debt and ease monthly financial stress.Buyers Have More Options

Housing inventory is improving, and home price growth is slowing. This creates a short-term opening for buyers to find more options before rising construction costs and economic pressure tighten the market again.

There’s a growing concern across the United States this year about stagflation – a combination of high inflation, stagnant economic growth, and rising unemployment. The possibility of a stagflationary environment in the U.S. economy has some economists raising alarms about potential effects on everyday Americans, already in the midst of a cost-of-living and homeownership crisis. Let’s discuss the impacts that homeowners and potential home buyers could see in 2025.

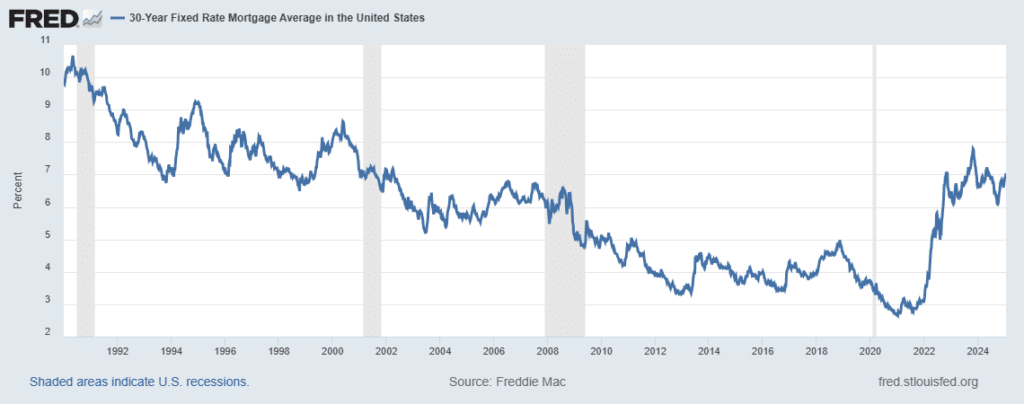

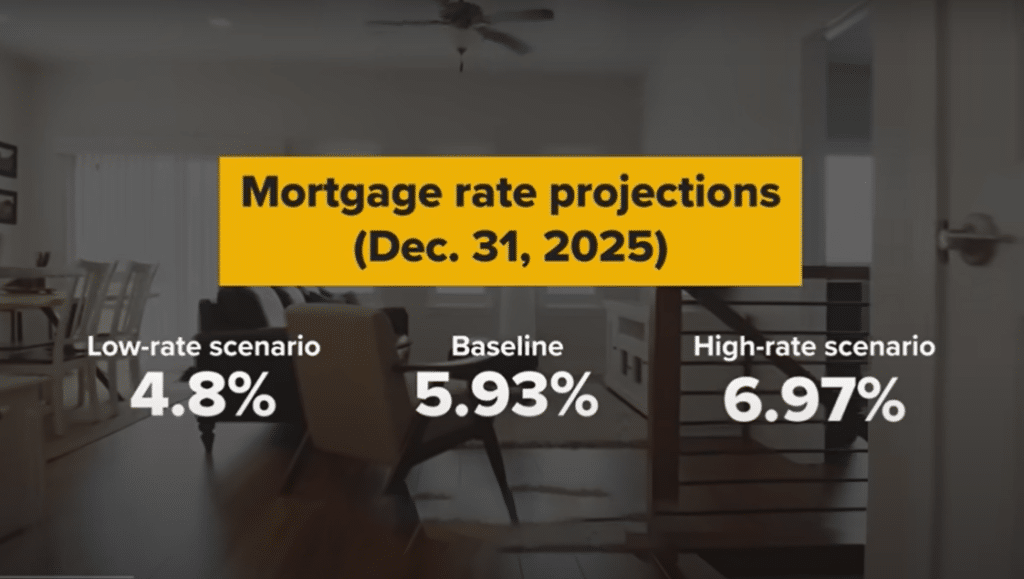

This raises an important question: Why haven’t these cuts made mortgages more affordable, and what can we expect to happen with mortgage rates in 2025?

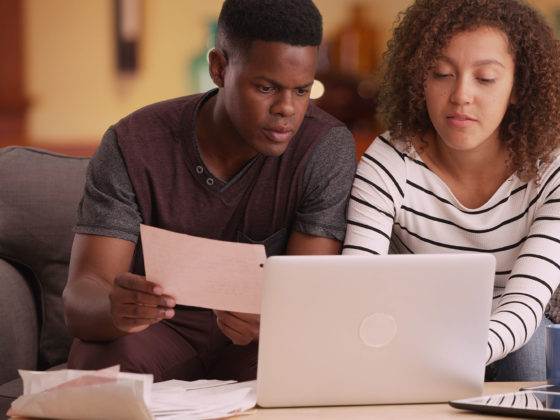

Debt and a Homeowner Cost-of-Living Crisis

Americans are experiencing increased financial pressures across the board – from higher costs at the gas pump and grocery store, to school activities, and mortgage payments. Rising property taxes and insurance premiums have led to higher monthly mortgage payments, even on fixed-rate loans, if they are paid out of an escrow account. And a startling survey showed 65% of homeowners have less than $5,000 in savings, and that 51% would struggle to cover an unexpected $500 expense.

High home values means there is some good news for homeowners who are facing mounting credit card debt and shrinking savings accounts… cashing in on equity is a much lower-interest way to pay off debt and reduce monthly bills to get some relief for over-stretched budgets.

Current Housing Market Trends

Despite today’s mortgage rates, home prices are projected to rise by 3.5% annually through 2027. This is great news for existing homeowners who will see home equity gains. This may sound disheartening to potential home buyers, who are caught between high rates and high home prices, but these projected home prices mark the slowest growth in the market since 2011.

The housing supply has improved over the last six months as more existing homes hit the market and new construction homes are underway. The next few months represent a key opportunity for home buyers to take advantage of the increase in listings before tariffs trickle down into construction costs, increasing the prices on new homes.

Impact on Mortgage Rates

Perhaps the most critical economic impact that existing homeowners are monitoring closely is mortgage rates. The Federal Reserve has kept its target range for the benchmark Funds rate between 4.25% and 4.5% since 2024, in an effort to tame rampant inflationary pressures. If we continue to see further inflation and cost-of-living increases this year, mortgage rates would be expected to remain around 7% or even higher due to economic policy.

Strategies for Navigating Stagflation

- For Homebuyers: Consider locking in mortgage rates now to avoid potential future increases. Ask your loan officer about loan programs that can help you get into a home based on your down payment, income, and credit situation. If rates come down, prices will go up even further. Better to lock in today’s prices and know you can always refinance into a lower rate.

- For Homeowners: Make sure that you’ve applied for any Homestead tax exemptions available to you in your state to reduce your property tax burden. Shop your homeowner’s insurance every year to limit monthly mortgage payment increases due to escrow changes. If you have other high-interest debts, consider cash out options to cut those high monthly bills.

Wrapping Up

Stagflation would add further stress to both homeowners who are already dealing with cost-of-living increases and stagnant wage growth. Homeowners still have the flexibility to leverage their equity to cover much-needed home renovations or repairs, as well as combat increasing levels of high-interest credit card debt to free up their finances.

Some additional good news for home buyers this summer – the steep growth in home values over the past several years has stalled, as record numbers of sellers put their homes on the market. Forecasts suggest that this influx of new housing inventory will drive down home prices, which creates a less competitive market and more options for home buyers to find their dream home going into the summer.

Heating Up Your Home: Lower Your Winter Power Bill

Read more...